Corporate Governance: The foundation of corporate sustainability and its requirements

Corporate Governance is understood as the set of rules, principles, policies, and procedures that regulate and define the structure and operation of a company's governing bodies. It establishes and regulates the relationships between shareholders, the board of directors, the management team, and stakeholders, regulating the decision-making process for long-term value generation.

History requires us to place concepts such as transparency, truthfulness, good practices, and corporate behavior, strongly activating reputation as an essential value to be strengthened over time.

Empirical evidence has shown that part of the benefits of having a solid and well-defined corporate governance are achieving permanent growth over time, favoring access to financing (debt and equity), attracting talent, and helping to build a strong brand. In short, they make companies more attractive, sustainable, profitable, and competitive, thus achieving greater market value.

Empirical Evidence

Corporate Governance should be seen as the central support for business sustainability, where its actors (companies and investors) control risks and achieve greater profitability.

To achieve these goals, it is important to constantly measure the performance of organizations in this area. Currently, the best information available is found in the Corporate Governance 2020 Annual Study conducted by Governart and VigeoEiris and supported by the Universidad Adolfo Ibañez.

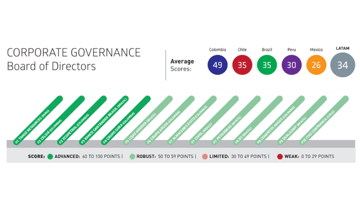

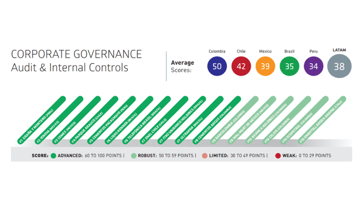

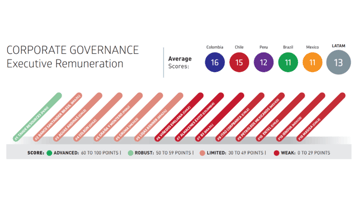

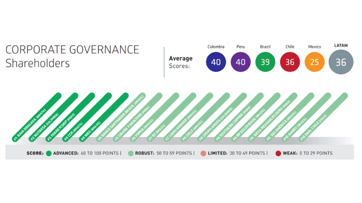

This analysis covered 139 companies surveyed in five countries: Brazil (55 companies); Mexico (28 companies); Chile (26 companies); Peru (18 companies) and Colombia (12 companies).

The aspects evaluated were:

- Shareholders

- Board of Directors

- Audit and Internal Controls

- Executive Compensation

- Corruption prevention

- Prevention of anti-competitive practices

- Transparency and Integrity and Influence Practices

Some of the findings are presented below.

Regarding ESG criteria in corporate governance, the study showed that the integration of these criteria through strategic planning and operational activities harmonizes the vision and unifies criteria in the organization, facilitating social responsibility processes. However, only 17% of companies review these issues at board meetings and only 28% have a dedicated sustainability committee.

It was concluded that currently in Chile the Corporate Governance criteria are deficient, or have a lot of room for improvement, but it must be fast. Chile stood out positively in the control of anti-competitive practices, but the clear winner was by far Colombia. Likewise, it was identified that the great difference between the companies of the different countries and the result observed is that when companies manage to understand that Corporate Governance is strongly linked to the business, significant improvements begin to take place.

What is the market asking for?

The market is not asking for things that have not been discussed for years, what it wants today is for all definitions to be in writing, to be communicated throughout the organization, and to become part of the organizational culture, but most importantly, for stakeholders to be informed on an annual basis.

Investors want transparency and consistency and are pushing for it, supported especially by financial market regulators. In this sense, they are looking for a minimum amount of information to be disclosed, that it be standardized, and that what companies report be at least comparable for the same industry. However, few companies have yet joined this trend and it is expected to change rapidly in the next three years.

What is happening in the region?

It is important to understand that today the broadest vision of sustainability is summarized in the acronym ESG (Environmental, Social & Governance) or ASG in Spanish (Ambiental, Social y Gobiernos corporativos).

In other latitudes, the adoption of this vision has advanced very rapidly and as a whole, while we see that in the region there is lethargy, which is why institutional investors and regulatory agents have been setting the pace.

In Chile, the Financial Market Commission was the body that took this first big step, making it the first country in Latin America to enact a specific regulation on ESG with a specific chapter on Corporate Governance, where all the requested content is very much in line with the information that companies are reporting according to international standards.

Among the elements that stand out is the role assigned to the board of directors, where the information requested will clearly show how the company is being managed in form and substance and implicitly determines the responsibilities. Likewise, it clearly establishes the role of the executives in this process, where the disclosure and adoption of the Governance Framework are not questionable. Many speak of stripping the company bare, while others call it transparency.

What is clear is that there is a cross-cutting consensus in the region on the need for this information and it is expected that regulators in other countries will take the same step in the very short term.